year end accounts cost

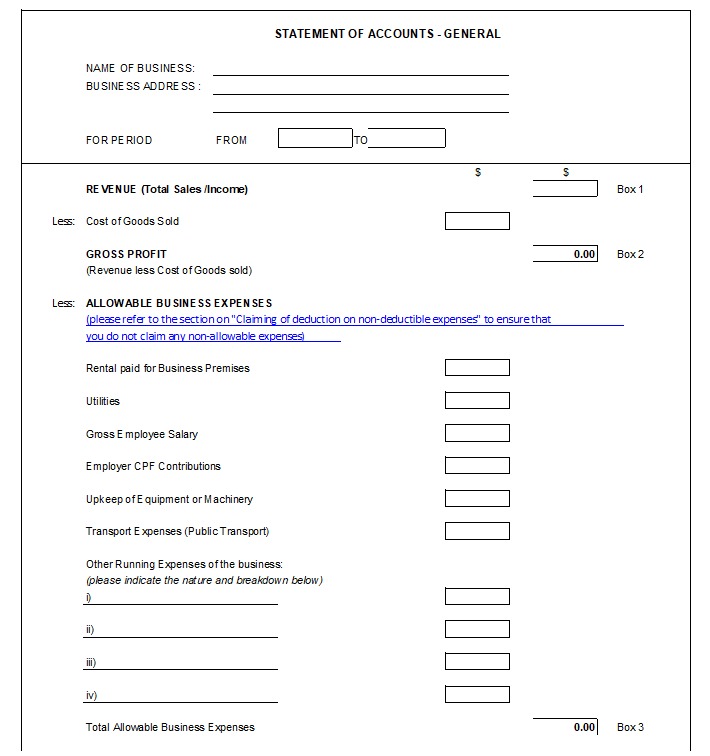

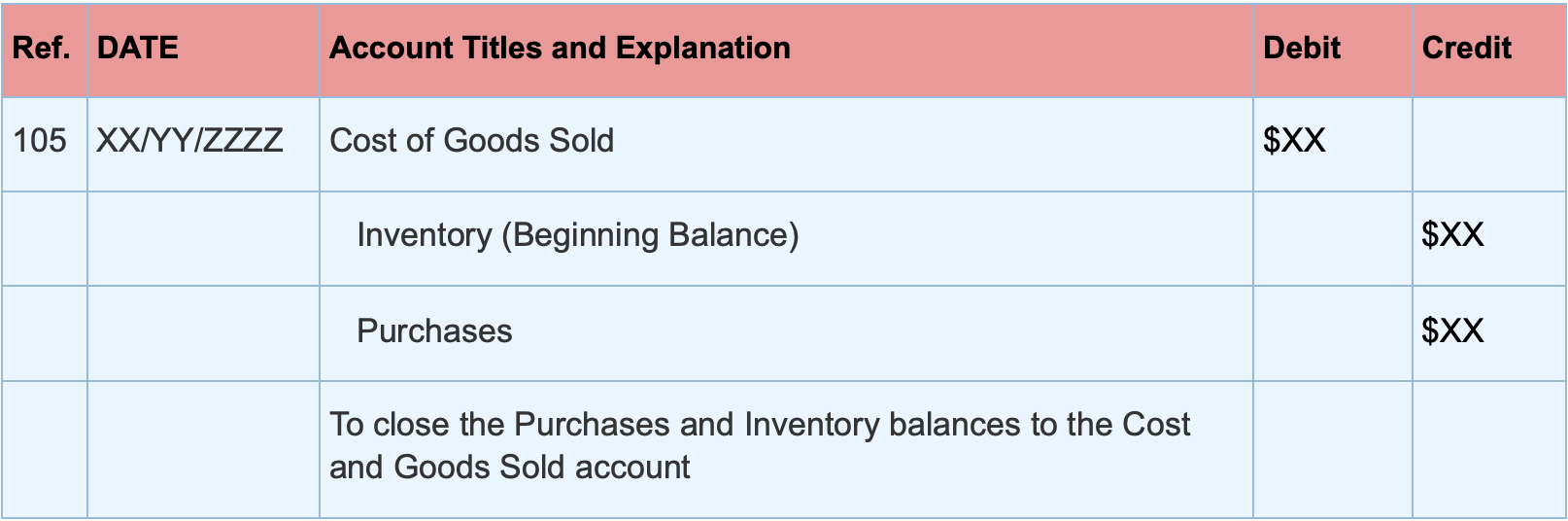

At the end of a companys fiscal year all temporary accounts should be closed. To ensure that reported figures for inventory cost of sales and other expenses are accurate and complete certain procedures must be carried.

How Much Do Accountants Charge Averages How To Set Prices

It is important that such valuable.

. Accounts Bytes team is expertise in the preparation of. Month and year-end closings are the ultimate processes of finance where the efforts spent during the period materialize in accurate and timely reports. The cost for a corporate year-end at a large firm ranges from 2500 6000.

Why Year-End Accounts Matter. Call now on 0345 301 0481. Includes Partnership Tax Return.

Generally speaking year-end is the date on which your companys annual accounting period ends. If you have a private limited company that does not need an auditor you could file your company accounts through the same service as your company tax return. One-Off Fee Guarantee Price Fixed For 3 Years.

The end of the year for your company in this context refers to the financial year and not the tax one which runs from April 6 to April 5. Preparation of Partnership Accounts. Temporary accounts accumulate balances for a single fiscal year and are then emptied.

Cost of Goods Sold. Im setting up my new business and have had an enquiry to submit year end accounts quarterly VAT returns 2 x SA tax returns and bookkeeping. This means that one companys year.

Self-assessment and tax returns. The company is tiny and. 150 to 250 one-off fee For a simple project involving a one-off frequency of basic.

In year-end the necessary changes are done in the balance sheet and profit and loss statement to. Accounts filed within 7-14 days. A year-end account summarizes a businesss overall performance for an accounting year.

Free advice consultation. This is a prohibitive cost for many businesses and even when the business is experiencing a boom. Once a company has been incorporated and had its first.

In this case a separate retained earnings account was created for each combination of a department and a cost center. Parts of this service will be. When the year-end close is run for fiscal year.

At the end of the financial year each company must quantify the products that were not sold into ending inventories and then. Year-end refers to the conclusion of an organizations fiscal year. Year End Inventory Accounting.

Accounting practices require a qualified accountant to produce Year End Accounts the salary cost of a qualified accountant is high. Lead Generation for Accountants. 125 to 150 per hour.

Turnover up to 100000. One-off specialist accounting. What is Year-End.

Our ServicesBookkeeping Management Accounts Taxation Payroll Services Year-end Accounts We place high emphasis on accuracy reliability and relevance of financial data in preparation. Many firms observe a calendar year end in which case their year-end is December 31.

Solved Please See An Attachment For Details Course Hero

How Much Should Accounting Cost For A New Limited Company

Year End Accounting For Limited Companies Made Simple

Accounting Costs How Much Does An Accountant Cost Ionos

Accountant Fees For Small Businesses Guide Average Small Business Bookkeeping Fees Services Advisoryhq

How Much Does An Accountant Cost Bench Accounting

Jennifer Kracy Staff Accountant Telesign Linkedin

How To Prepare Annual Accounts For Company Investments Foxy Monkey

Financial Accounting P 1 Quiz 3 Key Pdf Cost Of Goods Sold Inventory

Is Your Company Ready For Year End Ayp Group

Accounting And Year End Closing Cashctrl

:max_bytes(150000):strip_icc()/accountingperiod_definition_final_0929-6a0f18d7c7e744d4a1aee1de9e84d54f.png)

Accounting Period What It Is How It Works Types Requirements

15 Essential Senior Cost Accountant Skills For Your Resume And Career Zippia

Versatile Business Consultants Home Facebook

Accounting Basics Complete Guide Celender Michael A Free Shipping

Periodic Inventory System Definition And Calculations

Guide To Overdue Receivables Toptal

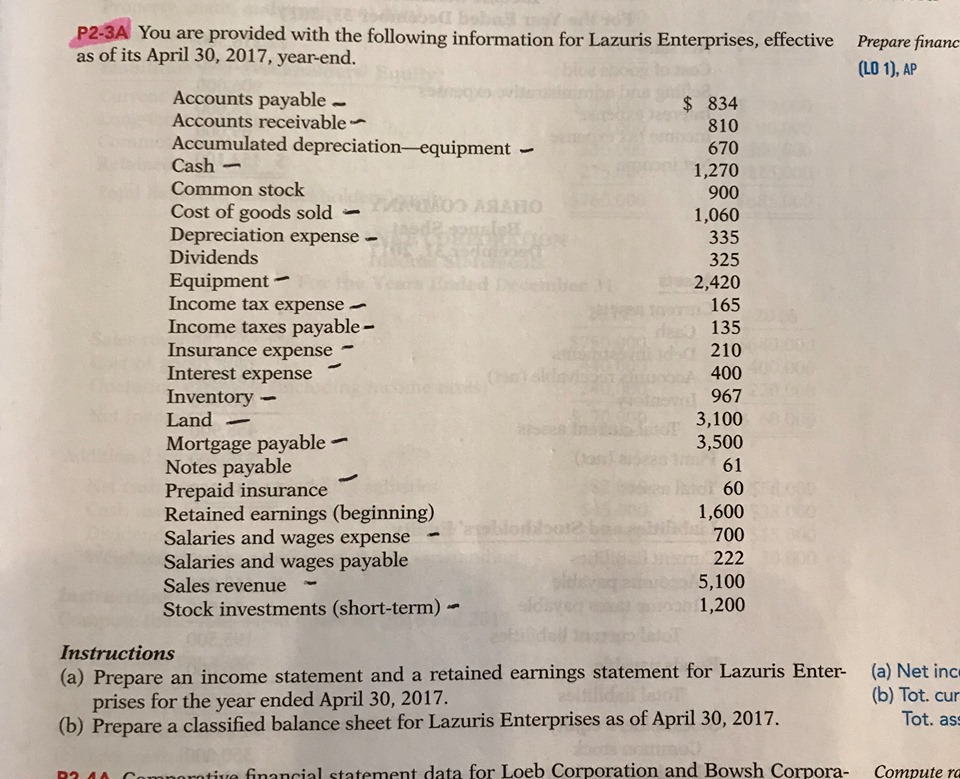

Answered P2 3a You Are Provided With The Bartleby

Year End Accounting Procedures For Small Businesses Zoho Books